In Ghana, providing financial education is an expensive, yet indispensable task for MFIs, especially for loan-issuing. Microfinance beneficiaries that receive training are 96.7% less likely to default on loans. As such, Certain institutions deploy formal financial education programs that train customers for two to five weeks before disbursing credit. Other MFIs forego formal training and require customers to contribute to savings accounts as a way to assess their financial discipline and build commitment.

Nevertheless, the objective remains the same for MFIs: ensuring that customers possess the ability to manage money effectively. However, with lack of financial literacy being endemic in Ghana, MFIs often choose to educate communities to increase their customer pool. In those instances, two important questions arise. How does an MFI know if its education program is successful? How should an education program be structured to effective (and economical)?

How MFIs Benefit from Education Programs

Better selection of customers

A 2014 study in Ghana cited improper client selection as a major cause for loan defaulting. From the beginning of the process, MFIs fail to filter out inadequate applications and have to support non-performing customers. For group loans, this problem is even more dangerous as it can lead to the failure of the entire group through “domino defaulting”.

A robust education program can mitigate this problem by helping loan applicants self-select better. It is helpful to discuss the common reasons for loan delinquency with customers (fund diversion, multiple loan-taking, etc.) and explain their consequences. In group loans, members clearly understanding their joint responsibility and patterns of failure increases the quality of the group formation process. For individual loans, education allows customer to assess if they will benefit from taking credit.

It has also been reported that training can increase savings in customers by 49%. MFIs can play a key role in helping savings depositors set savings goals and achieve them by learning how to budget and prioritize expenses.

Retention of customers

With 350 financial institutions licensed to provide microfinancial services in Ghana, there is stiff competition in certain parts of the country to attract and keep customers. This compels MFIs to find ways to differentiate themselves from other lenders. Education can play a role in this endeavour. By establishing trust and providing value to customers, MFIs can create a relationship with their clientele going beyond financial transactions and retain them longer.

It must be noted, however, that when education programs delay considerably the disbursement of loans, customers may be deterred and look for other sources of capital.

Upselling opportunity

MFIs in Ghana are adapting to their customers' needs by providing new financial services adapted to their circumstances. Products like insurance, investments and high yield saving accounts often are not well understood by MFI customers.

MFIs can leverage education sessions to introduce these products to their clientele and sell them beneficial financial services.

4 Tips for a Successful Education Program

1 - Leveraging (existing) Training Guides

When it comes to education, Ghanaian MFIs can save greatly by not reinventing the wheel. From producing educational content to capacity building for employees, significant resources have to be invested to deploy a valuable training program. By using publicly available microfinance training material, MFIs avoid unnecessary costs.

Groups like the WWF or the ILO have produced exhaustive training manuals (click on the links to access them). This material can be used to upskill loan officers and customers faster and with a defined structure.

2 - Setting Goals

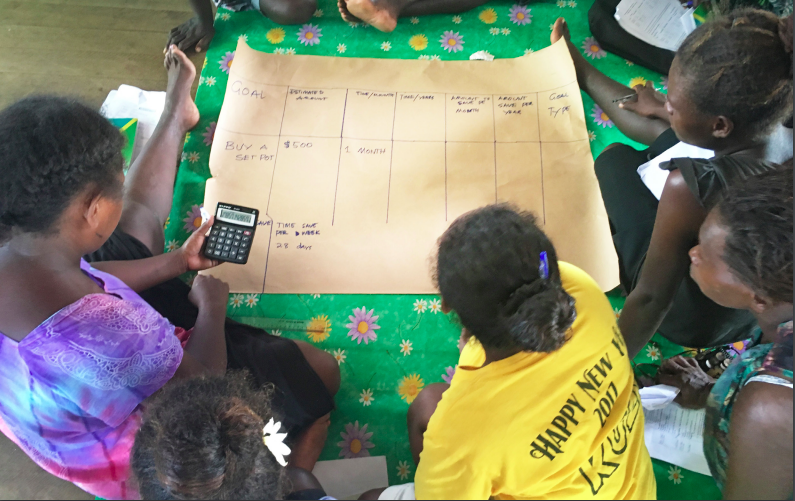

Helping customers set financial goals can seem like a superfluous step but it can dramatically change their performance. For instance, the likelihood of saving can increase by 15% by defining goals for depositors.

For MFIs, setting goals with customers is the perfect opportunity to define expectations and the benefits of financial services for communities. Customers should be asked to list their business or personal goals then prioritize them by importance and feasibility.

It is important to use this opportunity to explain the consequences of delinquent behaviour like fund aversion or unwillingness to pay (e.g: debt collection, inability to obtain loans in the future, etc.). This allows the MFI to align expectations with customers early.

3 - Teaching Savings first

Savings play a fundamental role in the relationship between MFIs and their customers. For loans, they constitute the role of an indirect collateral that can mitigate credit risk. Savings also enable customers to access other financial products such as insurance and investments.

We recommend that every financial education program begins with training on the importance of savings. MFIs should also incentivize customer’s to save and include savings scheme in their loan offerings.

4 - Continuous Education

The most important feature of a financial education program is that it continues throughout the relationship with the customer. This ensures that MFIs stay connected to their clientele, collect more information to better serve them and suppress delinquent behaviour. For loans, it has been shown that borrowing experience increases the likelihood to default. This means that MFIs need to provide rigorous training at the beginning of each loan cycle to maintain desired performance in customers.

For successful customers with more capital available, learning about insurance and investments allows them to use more of the MFI’s services and benefit further from the relationship.

To that end, weekly and monthly meetings must be used effectively by MFIs to introduce new concepts and make financial education a continuous process.

Ultimately, uplifting communities through education is more than correct business practice, it is a social responsibility. It is an investment that stands to pay dividends for years to come in Ghana. Fluid is committed to that mission. We are currently producing video content to educate customers in local languages. If you are interested in learning more, visit fluidfinance.co.