What sets apart good microfinance institutions (MFIs) from others? Fluid’s research initiative in Ghana sought to answer that question by studying 30 MFIs across the country. While models of financing or areas of operation may differ, one consistent indicator of quality in MFIs stood out - the effectiveness of their field agents.

Loan officers and savings depositors in the field are the breadwinners of microfinance. They play the role of loan appraisers, bank tellers and customer service representatives all in one. They are the final point of strategy execution and the first point of information collection.

Yet, managing field officers is a delicate exercise of balance. Field Officers have to endlessly expand the MFI’s business by bringing in new clients while ensuring to filter out delinquents. They have to collect large amounts of payments, often without supervision, and remain honest. They must strive to maintain positive relationships with customers while enforcing MFI policies.

In this article, we will explore common areas of improvement in field officer management and discuss how technology and strategy can help MFIs make their agents on the field more effective.

Where Things Break

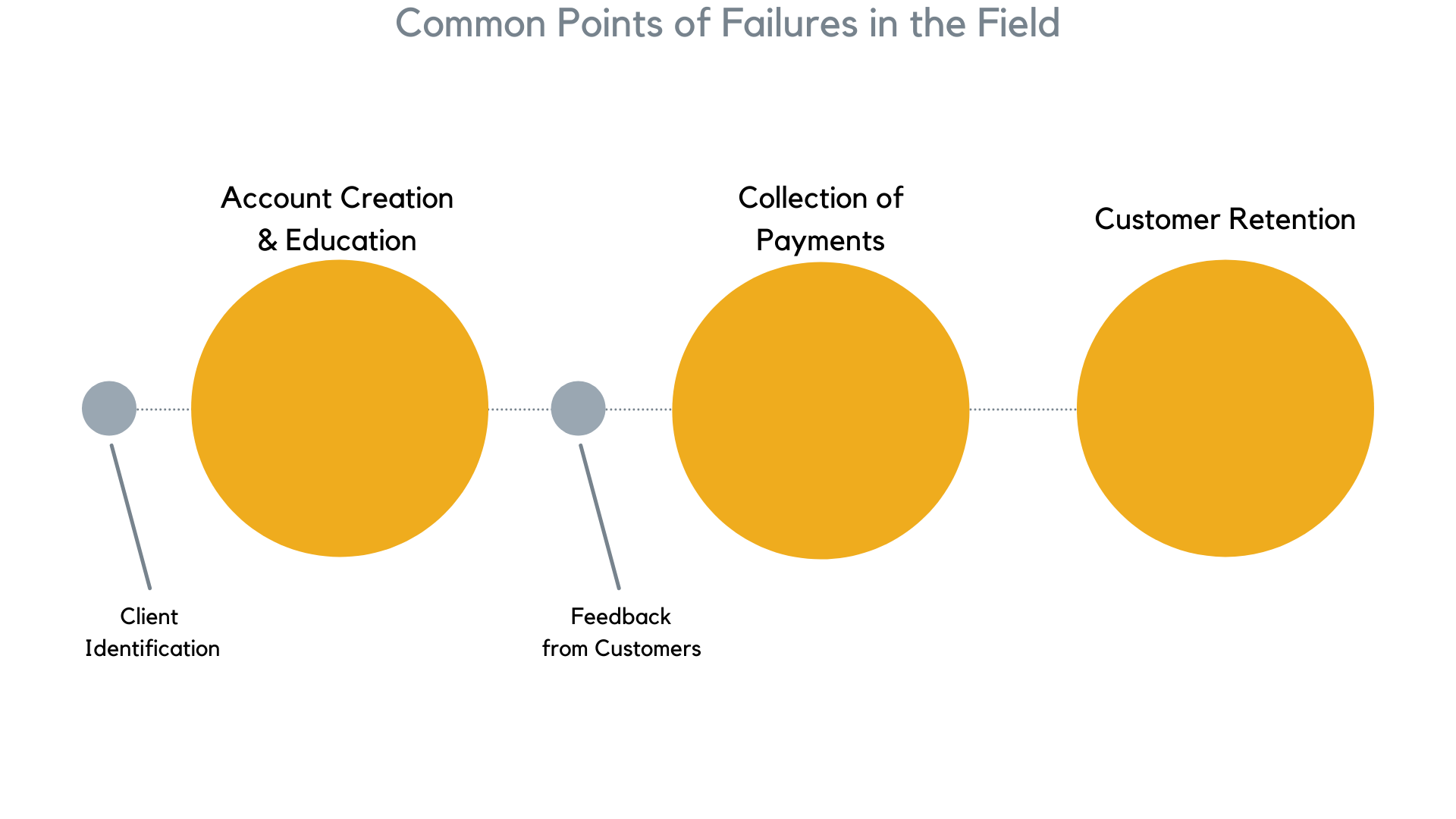

From the moment they leave the office, Field Agents acquire high levels of agency to deal with customers. On behalf of their MFI, they typically handle 300-500 customers and act as the only bridge between the client and the financial institution. Naturally, this system creates a lot of reliance on the Field Officer and failures can take place at any stage of the business lifecycle.

However, MFIs report that the vast majority of “field failures” tend to take place at three stages:

- Account Creation & Education: When Field Agents begin the process of loan or savings account application with customers and provide them with education.

- Collection of Payments: When Field Agents collect loan repayments or savings deposits.

- Customer Retention: Throughout the microfinance lifecycle, how well Field Agents manage to satisfy customers and retain their business for the MFI.

Account Creation: Maintaining Quality

As MFIs grow their business and offer services to more customers, Field Agents are tasked with prospecting new clients and sell them financial products. They must also conduct due diligence processes to weed out bad customers (e.g: delinquent borrowers).

The obvious challenge in this task is to ensure that expansion does not decrease the quality of the MFI’s customer pool.

In Ghana, widespread disbursements of bad loans have caused the downfall of many MFIs, especially during the 2019 banking clean-up. To “pump up the numbers” or to commit fraud, Field Officers have neglected their duty to appropriately screen loan applicants and caused large defaults for their organization. In addition, limited levels of education and training limit Field Officers' ability to rigorously evaluate potential borrowers and their business.

This problem also applies for savings account creation. Often, individuals with no intention of saving are made to open accounts by Field Agents to inflate their statistics. However, these inactive accounts only consume resources for the MFI with very little return. One MFI Manager told the FLUID research team:

We do not let customers open savings accounts without a goal in mind. Only customers that have clear financial goals tend to actually make use of their savings accounts.

The reality is that while Field Agents can collect information on the field, it is bad business practice to have Field Agents select which customer will receive a loan or open a savings account. Conflicts of interest or lack of skills make Field Agents prone to errors of judgement. Moreover, much productivity would be found by having Field Agents focus on collecting information on prospects and deferring decisions to more trained staff.

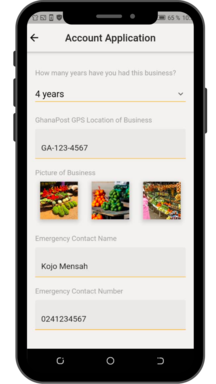

MFIs should employ digital information collection systems to aid Field Agents screen prospects properly and have appropriate staff approve or reject customer applications. FLUID has developed the Wealth Creation Assistant App to have Field Agents collect customer information in a digital format and have MFI managers make decisions in real time.

Payments: Honesty & Speed

Payment diversion by Field Agents or customers is a painful problem for MFIs. Due low monitoring on the field, agents are continuously tempted to embezzle. Customers, facing incessant economic pressure due to their low income, can also be found guilty of diverting payments, especially when the MFI takes time to collect. As such, MFIs have to ensure that Field Agents remain honest and collect payments as soon as they are available.

Field Agent embezzlement is caused by two issues in the microfinance industry:

-

The Illiteracy of MFI customers

-

The ability for Field Agents to conceal information to their MFI

Due to payments being recorded on passbooks, illiterate customers often have no way of knowing if the amount paid to a Field Agent was properly reported. This problem worsens in remote areas. The Field Agent assigned to an isolated community is often the only point of contact customers have, creating even more room to commit fraud.

Likewise, MFIs often possess very little context on customers outside of Field Agent reports. We have seen multiple examples of Managers not knowing loan borrowers or savings depositors and relying exclusively on Field Agent to handle the relationship.

To solve the problem, MFIs need to break the dependence on Field Agents. The best option to do so is mobile money. However, slow adoption in rural areas as well as transaction fees make this method unpopular amongst clients.

Some MFIs have adopted Field Agent rotation programs. To limit the ability of an individual to have too much control over a community, agents are moved from one location to the next periodically. While this solution limits Field Agents from concealing information from MFIs, it does not solve the problem of customer illiteracy.

FLUID is solving the embezzlement problem by introducing Biometric Payment Technology to Field Microfinance. Our system allows customers to use video recordings when making payments to ensure integrity and accuracy during collection. This solution also allows Field Agents to increase their speed and decrease the likelihood of customer diversion of funds.

Retaining Customers

The issue of customer retention has been discussed in a previous article (click here). Ghana is becoming a more competitive market in microfinance and it has become easy for disgruntled clients to move to a competing MFI.

Because Field Agents handle customers alone, instances of client abuse or unprofessionalism can go unnoticed. MFIs can mitigate this problem by performing customer satisfaction audits on Field Agents to uncover bad behaviour and keep clients satisfied.

Any strategy is only ever good as its execution. Many MFIs create financial schemes to uplift Ghanaian financially. However, poor management of Field Agents can foil any MFI program. FLUID is developing technology to help MFIs enforce rigorous due diligence, payment collection and customer satisfaction on the field. If you are interested in learning more, visit fluidfinance.co