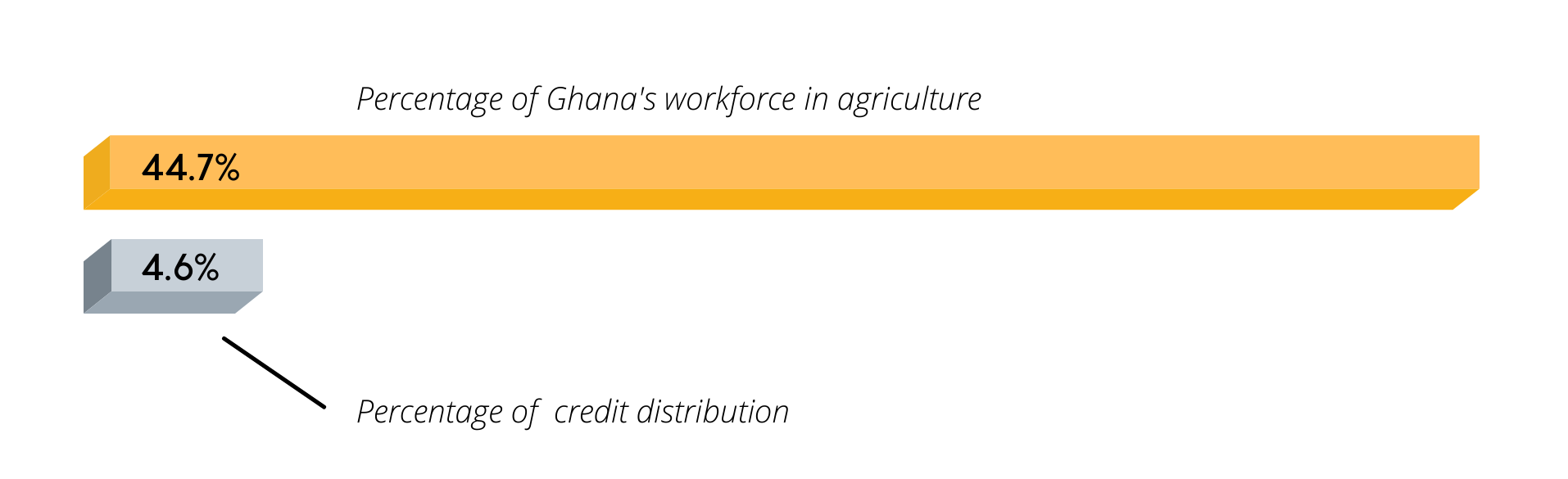

Agriculture in Ghana is both a giant and a dwarf. With 44.7% of employed Ghanaians working in farming in 2020, it stands as a mammoth in the country’s labour force. However, agriculture attracted only 4.6% of all loans disbursed in the same year (Bank of Ghana) - a minuscule number.

Weather-based risk is one of the main causes of this dysmorphia within agriculture. Lenders shy away from financing small-sized farm owners due to their dependence on favorable weather for successful crops. And with 60% of farms in Ghana sizing less than 1.2 hectares, a massive gap in financing is created in the largest sector of the country’s economy.

Insurance represents a catalyst of change for Ghanaians farmers. By leveraging technology and microfinance strategy, lenders and investors can now control risk and engage farmers with attractive financing schemes. Newfound financial security will also increase farmers' willingness to make investments to drive up their efficiency.

This article will discuss how microfinance institutions can benefit from insurance technology and effective strategies to scale farmer financing with appropriate risk exposure.

Index Insurance - Solving the Weather Problem

Traditional insurance is not adapted to small sized farmers due to a crucial factor: the cost of information collection. Insurance providers have to visit each farm to define coverage and, in the event of crop loss, perform a second assessment to verify the validity of the claim. For small farms located in remote areas, the cost of travel and information collection is often higher than the value of the insurance itself. Additionally, it is difficult to determine if crop losses are due to external factors or farmer delinquent behaviour.

Index insurance solves those issues by estimating crop losses with measurable environmental conditions, the “index”. Modern weather satellites can predict crop yield around the globe with great accuracy. Relying on this technology, index insurance provides coverage to farmers by detecting weather shocks in their area and issuing automatic payouts. By mitigating external factors, the onus is placed on the farmer to generate successful crop yields.

For Microfinance lenders, such an insurance scheme presents a golden opportunity to further penetrate the agricultural market in Ghana. It has been reported that farmers are willing to trade 11% of their income to fully eliminate crop yield risk. Index insurance can be adjusted to cover some external risk while remaining affordable for MFIs and attractive for farmers. FLUID is currently working with rural microfinance institutions and stakeholders to develop an index insurance product designed for Ghanaian farming.

Group Input Financing - Eliminating Moral Hazards

The control of external factors does not make agriculture financing default-proof. Like traditional microfinance, the risk of delinquent behavior remains apparent for MFIs. Small sized farmers face daily economic hardship and, when presented with capital, can be tempted to misuse funds. In addition, due to farms' remote locations and longer production cycles, monitoring systems like weekly meetings are generally ineffective.

MFIs should employ tight social bonds in farming communities as well as their need for inputs in lieu of cash to limit negative behaviors from borrowers. Prominent Rural Banks in Ghana, such as Amenfiman RB or Bessfa RB deploy group input financing schemes to fund agricultural activities with great success. The rural banks associate with groups of farmers to provide inputs such as seeds, fertilizers or equipment rental in exchange for payment at the end of the crop season. Such schemes generate high repayment rates for farmers since all the capital is spent productively. Malpractices such as side selling are prevented by making group members liable for the repayment of their peers - thus creating social collateral for lenders.

Click here to read more about group lending

Efficiency through Scale

Smallholder farmers represent a fraction of the agricultural value chain. Presently, the lack of organization and access to buyers and logistics compels farmers to sell their outputs at low prices to middlemen (NY Mag). MFIs can solve those inefficiencies by aggregating farming cooperatives and match their input financing with group sales to purchasers, thus increasing the economic output of each individual farmer.

Likewise, index-based insurance schemes will increase their effectiveness as more farmers and lenders seek protection. By pooling premium payments from multiple parts of the country with different environmental conditions, index insurances are able to diversify their risk profile and provide more security to MFIs and agriculturalists.

FLUID is committed to scaling financial inclusion for farming communities. We are developing technology to help financial institutions deploy capital in rural areas effectively and control their risk. If you are interested in learning more, visit fluidfinance.co.